At Bank of America Private Bank, we take pride in our history and in serving our clients’ best interests. We also value the continual pursuit of innovation in a constantly transforming world. We apply this perspective to help our clients anticipate and respond to evolving markets, changing environments and the growing complexities of the financial landscape. Mindful of the past, our focus is on providing today’s clients with disciplined financial strategies and a bridge across generations.

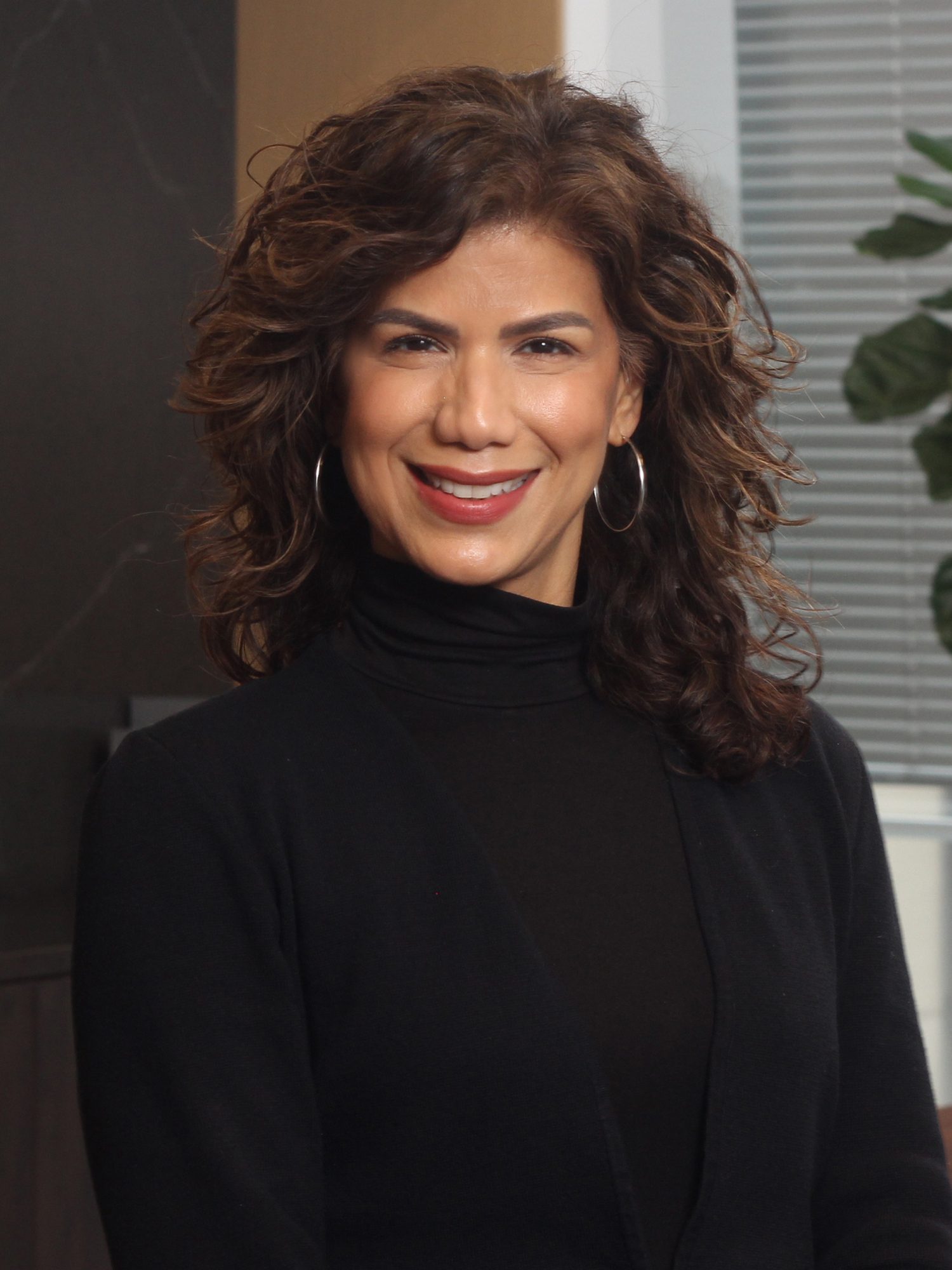

Jennifer P Alvarez

Vice President, Trust Officer

Professional Profile

Jennifer P. Alvarez is a Vice President and Trust Officer at Bank of America Private Bank in New York, New York. She is responsible for providing comprehensive wealth management strategies to high-net worth individuals and families. Jennifer provides guidance on developing and implementing estate plans, including advice on wealth transfer strategies that align with the client’s long-term objectives, and providing fiduciary oversight of trust, retirement and investment management accounts.

Jennifer has over 15 years of wealth management experience working closely with ultra-high net worth client and families. Prior to joining Bank of America Private Bank, Jennifer worked as a Private Banking Associate at Bank of New York focusing on servicing the banking needs of high net worth clients and prior to that she worked in a similar role as a Private Banking Senior Associate at U.S. Trust Company of New York.

Jennifer received her bachelor’s degree in Business Administration from The Bernard M. Baruch College in New York, New York.

Private Bank CIO Audiocast Series

Tune in at 2:00 PM EST on Monday and Friday for the latest insights.

Let's Have A Conversation

We take the time to listen and learn about you and your family before creating strategies that aim to meet your needs, goals and best interests now and in the future

FEATURED ARTICLES

EXTENSIVE REACH, INNOVATION AND A LEGACY OF TRUST

For more than 200 years, Bank of America Private Bank has helped clients navigate the complex challenges of managing significant wealth. We draw on the Private Bank’s personalized approach, as well as the resources of Bank of America, to help individuals and families, businesses, and institutions achieve their financial objectives. Whether you’re looking to preserve and share wealth, build philanthropic legacies or plan for future growth, our commitment is to make your goals our priority.